Tax Collection

Manufactured Home & Real Estate Tax Collections.

Manufactured Home Tax

Mobile and manufactured home taxes are due March 1st and July 31st. If the due date falls on the weekend, taxes will be due the following Monday. These bills reflect current year taxes. Currently, Defiance County will accept payment by cash, check, or credit card. While many residents mail their taxes, we also have a drop box located in the alley between the post office and Key Bank. For personal service, payments are accepted in our office Monday through Friday, 8:30 AM until 4:30 PM.

Delinquent bills are mailed in September. The Auditor will prepare a listing of delinquent taxpayers for publication to local newspapers.

Ohio's Manufactured and Mobile Home Laws have changed recently. The law allows for different methods of taxation. They are the Drepreciation Method and the Appraised Method.

Penalty and Interest Dates:

- 03/01 - First half taxes due (last day to pay 1st half taxes without penalty.)

- 03/02 - 10% of the unpaid 1st half taxes will be added as penalty. If paid within 10 days after the due date, 5% of the penalty will be waived.

- 07/31 - Second half taxes due (last day to pay 2nd half taxes without penalty.)

- 07/31 - 10% of the unpaid 2nd half taxes will be added as penalty. If paid within 10 days after the due date, 5% of the penalty will be waived.

- 08/01 - Interest will be charged on unpaid prior years delinquency.

- 12/01 - Interest will be charged on total unpaid balance.

TIPP - Tax Installment Payment Plan is now available

You are now able to pre-pay your taxes monthly instead of semi-annually. You must be current to be included in TIPP. If you are behind in your taxes, see Additional Manufactured Home Programs. If you are interested in the TIPP Program, please call, stop in, or email us at treasurer@defiancecounty.oh.gov.

Additional Manufactured Home Programs

Homestead Exemption

As the Homestead Exemption program is undergoing changes, please see the Auditor's website or call them at (419)782-1926.

Board of Revision

If you feel your property is valued too high, you may file an appeal with the Board of Revision. (Ohio Revised Code § 5715-19). You must file with the County Auditor's office after the 2nd Monday in January and before March 31st.

Delinquent Contract Plan

We offer a payment plan for those who are delinquent in their Manufactured or Mobile Home taxes. Please contact the Treasurer's Office at (419) 782-8741 if you are interested.

Real Estate Tax

Real Estate tax bills are due February 5th and July 20th. If the due date falls on the weekend, taxes will be due the following Monday. Real Estate tax bills are mailed twice a year and are always a year behind. Currently, Defiance County accepts cash, check, or credit card (by calling 1-419-513-8745 https://govpayments.com/oh_defiance) as payment for taxes. The taxpayer is also able to pay their taxes by automatic withdrawal from their bank account either semi-annually or monthly. While many residents mail their taxes, we also have a drop box located in the alley between the post office and Key Bank. For personal service, we accept payments in our office Monday - Friday 8:30 am to 4:30 pm.

WATCH WHEN YOU PAY TAXES THROUGH YOUR MORTGAGE COMPANY. Approximately 30% of Defiance County taxpayers pay their taxes through their mortgage company. This works well until their mortgage is paid off. If you recently paid your house off and did not receive a real estate tax bill, please call our office. If you recently refinanced with another lender, review all the closing statements carefully. Some lenders do not have the ability to collect taxes and insurance with the payment. When changes occur the lender must notify us in writing. If you should be receiving a tax bill and don't receive one in January or June, call our office immediately.

Delinquent bills are mailed in September. The Auditor will prepare a listing of delinquent taxpayers for publication to local newspaper.

The taxpayer is ultimately responsible for taxes and can be charged penalty and interest if payment is late.

Penalty and Interest Dates

- 02/05 - FIRST HALF TAXES DUE (Last day to pay 1st half taxes without penalty.)

- 02/06 - 10% of the unpaid 1st half taxes will be added as penalty. If paid within 10 days after due date, 5% of penalty will be waived

- 07/20 - SECOND HALF TAXES DUE (Last day to pay 2nd half taxes without penalty.)

- 07/21 - 10% of the unpaid 2nd half taxes will be added as penalty. If paid within 10 days after due date, 5% of penalty will be waived.

- 08/01 - Interest will be charged on unpaid prior years delinquency.

- 12/01 - Interest will be charged on total unpaid balance.

TIPP - Tax Installment Payment Plan is now available

This program is to ease the burden of the large semi-annual tax bill by providing taxpayers with partial payment plans. Pre-payments can be made monthly during a six month period. You must be current to be included in TIPP. If you are behind in your taxes, see Additional Real Estate Programs. If you are interested in the TIPP program, please call, stop in, or email us at treasurer@defiancecounty.oh.gov

Additional Real Estate Programs

Homestead Exemption

As the Homestead Exemption program is undergoing changes, please see the Auditor's website or call them at (419)782-1926.

Board of Revision

If you feel your property is valued too high, you may file an appeal with the Board of Revision. (Ohio Revised Code Section 5715.19) You must file with the County Auditor's Office after the 2nd Monday in January and before March 31st.

Delinquent Contract Plan

This payment plan provides taxpayers with a vehicle for the payment of delinquent taxes while maintaining payment of current tax billings. The plan was developed to assist taxpayers who have been faced with financial problems and find themselves with delinquent tax balances. Taxpayers can now avoid foreclosure actions with the availability of this plan. Please contact the Treasurer's office at 419-782-8741 if you are interested. If you go on a delinquent contract and miss a payment, the contract will be void and foreclosure proceedings will continue.

HOW ARE MY TAXES CALCULATED?

Two factors establish the amount of taxes you pay.

1st - The primary factor is the market value of your property. The County Auditor assesses your property according to market value not historical cost. Every six years your property will be re-appraised. The next appraisal will be 2026 (payable in 2027).

2nd - The second factor is the levies or additional taxes that the voters choose to pay in order to receive additional benefit or service.

How to calculate your real estate taxes

Auditors Appraisal 97,430.00

Multiplied by 35% x 0.35

Equals the assessed or taxable value 34,100.00

Assessed value 34,100.00

Multiplied by the tax rate x 0.06085

Gross full year tax 2,074.99

Divided by 2/2 1,037.49

Equals the gross 1/2 year tax 1,037.49

Assessed value 34,100.00

Multiplied by the tax factor x 0.038493

Equals the adjusted tax 1,312.64

Divided by 2 / 2 656.32

Equal the adjusted 1/2 year tax 656.32

Multiplied by the 10% rollback x 10 % 65.63

Multiplied by the 2 1/2% Homestead rollback* x 2.5 % 16.19

Minus the Homestead Exemption** N/A

Equals 1/2 year net tax 574.50

Plus special assessments + N/A

Equals 1/2 year tax due 574.50

* To receive the 2-1/2% homestead rollback the owner of the property must reside in the home. This reduction is based on your home and one acre. Contact the Auditor's office for an application. Certain criteria exist.

** Homestead Exemption - This exemption gives a tax discount to people over 65 years of age or totally disabled people. For additional information on relief of tax burden, please contact the County Auditor's office at 419-782-1926.

WHERE DOES MY MONEY GO?

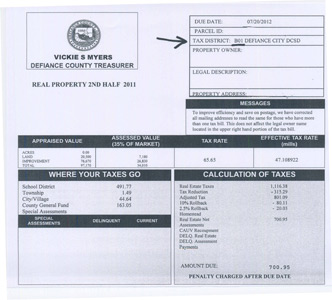

Look at the example tax bill below under "Where Your Taxes Go" to see how much each organization receives.

The 2025 Tax Rate Sheet will give the breakdown on how the money collected is distributed. For example, if you live in the City of Defiance and in the Defiance City School district, your Taxing District will be B01 or you can look at your tax bill for the taxing district.

Per Tax Rate

On the above sample tax bill for the 2nd half taxes of tax year 2011, the TAX DISTRICT is B01. According to the tax rate sheet for tax year 2011, the rates for B01 are as follows: Vocational School 3.20 + Library 0.75 + County Rate 11.25 + Township General 0.10 + School General 44.70 + School Bonds and Interest 2.65 + Corporation General 3.0 = Real Estate Net Taxes Total Gross Rate 65.65.